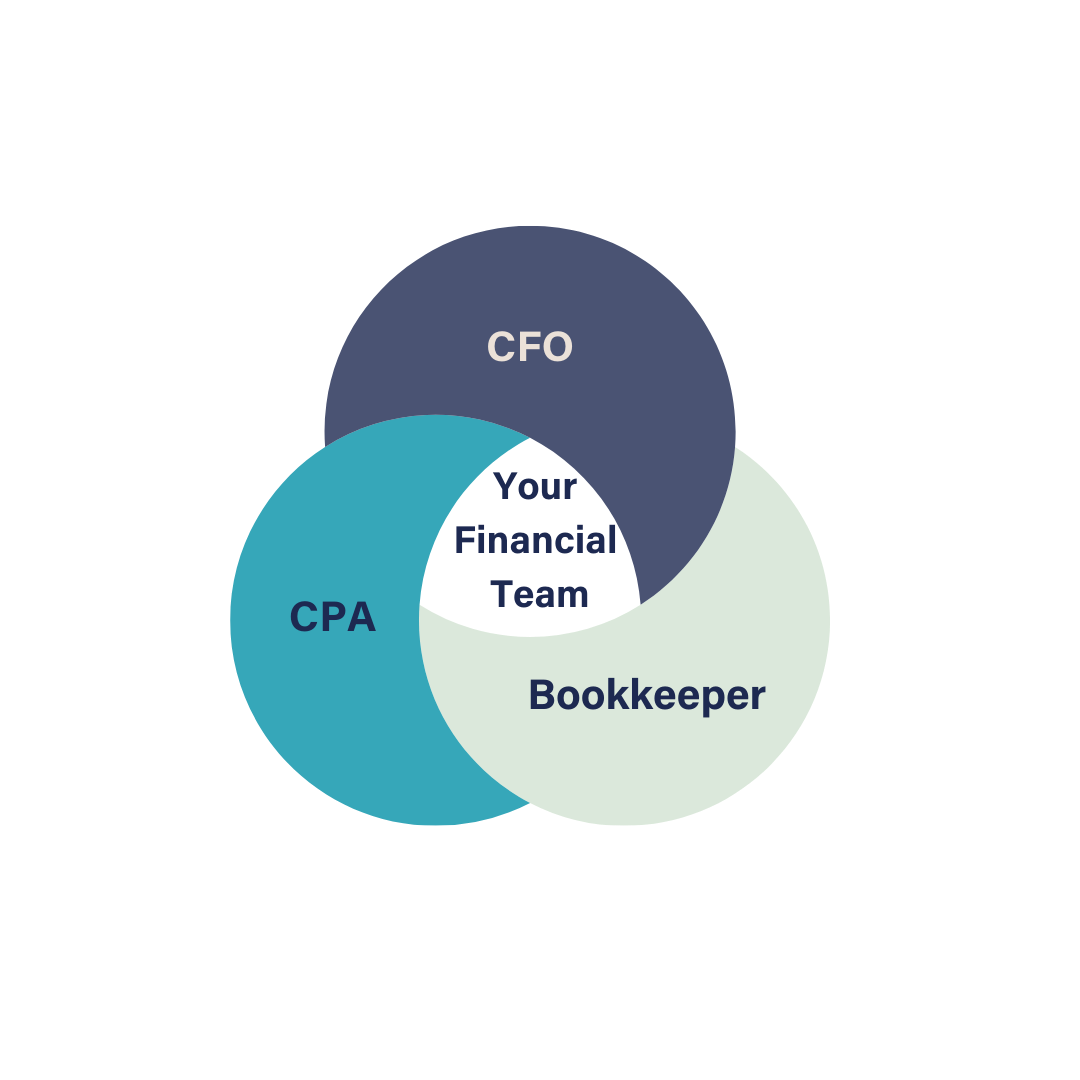

CPA, CFO, Bookkeeper Oh My! What is the difference?

Your Business’s Financial Professionals

All three of these professionals will help keep your business financially healthy and prepared for the future

Are you on target for reaching your annual goals? Are you hitting your benchmarks? Who is going to help you figure that out?

You most likely have three options:

Your bookkeeper,

your CPA or

your CFO (or outsourced CFO)

All three are key to operating a healthy business. Each has their own specialty and view of the company.

A bookkeeper is typically the first professional that a small business owner will bring in to assist with their finances.

Typical bookkeeping tasks include:

Processing and recording financial transactions in accounting software such as QuickBooks Online, Xero or Wave.

Recording sales, expenses, paying bills and sending invoices, tracking inventory and reconciling your bank statements to the records in your accounting system.

They also are frequently tasked with running or recording payroll and organizing and maintaining documents such as receipts and bank statements.

A note on what a bookkeeper will NOT do:

They will not analyze your financial results, provide guidance on improving your numbers, create financial and cash projections, or help you make decisions about the financial direction of your company.

A CPA is typically the next person contracted because - well, taxes!

A CPA typically focuses on all things accounting and tax.

They ensure compliance with tax laws.

They prepare and file your annual tax returns and assist with quarterly estimated taxes.

They also will represent you in the event of an IRS audit and will interface with the IRS on your behalf.

And very importantly, they strategize with you to minimize those taxes (which is very different from strategizing with you on how to grow and scale your business). That function belongs to the CFO.

Some CPAs offer CFO services. However, a CPA doesn’t usually have the same depth of strategic finance and industry experience as a CFO. Just as a CFO doesn’t have the same depth of tax experience as a CPA.

Now to the CFO or, in most cases with small to midsize enterprises, an outsourced CFO.

Your Chief Financial Officer, is focused on:

Setting forward-looking financial strategy and establishing overall financial management.

Guiding you toward maximizing profits and minimizing risks

Leading the financial piece of mergers and acquisitions

Raising capital

Providing guidance on how to improve your numbers and hit your benchmarks and metrics and help you set those metrics and identify the appropriate benchmarks

For a little more in depth discussion on these three important roles, check out Episode 3 of my podcast, which you can find here: Thriving in the Chaos or wherever you get your podcasts!

TLDR: